Jersey Jargon, April 2019

The 2018 Farm Bill offers dairy producers potential relief from low income over feed costs margins. The program, Dairy Margin Coverage (DMC), is patterned after its predecessor, the Margin Protection Program for Dairy (MPP-Dairy). However, it is expected to be much more effective in helping dairy producers get through difficult economic times. As with MPP-Dairy, DMC will be administered by USDA’s Farm Service Agency (FSA), and sign-up for the DMC begins in mid-June. Coverage will be retroactive to January 2019.

In this month’s Jersey Jargon column, we’ll explain basic information about the program and what it means for Jersey breeders. Detailed information can be obtained from FSA and producers’ milk marketing cooperatives.

The Basics

The DMC is an insurance protection program designed to provided indemnity payments when margins are squeezed due to low milk prices and high feed prices.

With the program, dairy producers pay an annual premium to obtain coverage for a selected level of production at a selected margin. Then, they are paid when margins announced by the USDA Farm Service Agency (FSA) fall within their coverage amounts.

What’s New

The new DMC improves on MPP-Dairy by increasing coverage levels and reducing premiums. Dairy producers can now cover 5-95% of their existing production versus 25-90% under MPP-Dairy.

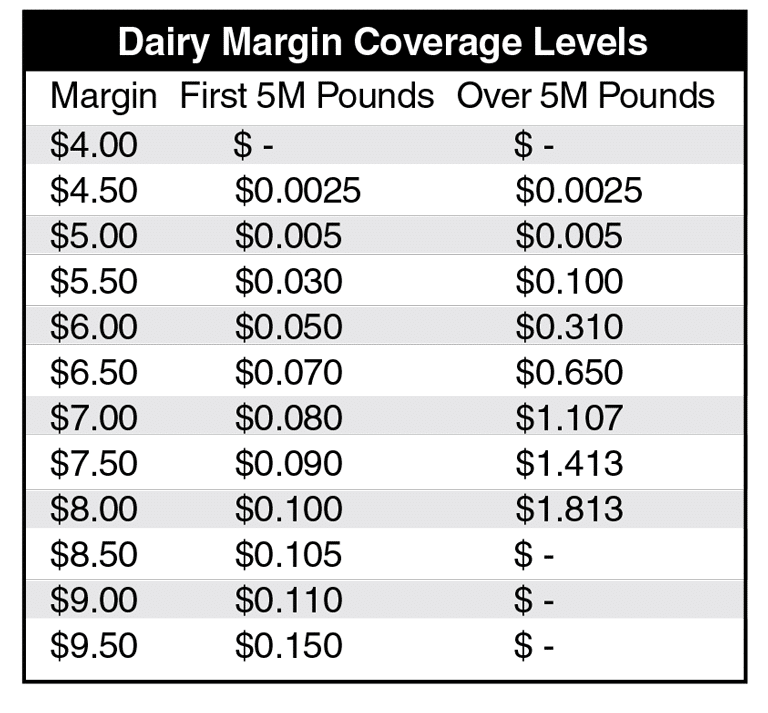

As well, DMC lets dairy producers cover income over feed costs margins between $4.00 and $9.50 in 50-cent increments for up to their first five million pounds of historical production. A producers’ historical production is based on the highest volume of milk marketed in 2011, 2012 or 2013. Previously, there were no options above $8.00.

Production above five million pounds can be covered in a second premium schedule between $4.00 and $8.00.

Producer premiums are also more affordable with the new DMC. The price of $8.00 coverage is now $0.10/hundredweight (versus $0.142/hundredweight for MPP-Dairy) and prices for $8.50-9.50 coverage are affordable. Prices for $4.50 and $5.00 coverage are uniform across tiers, reducing the cost of $5.00 coverage for operations covering more than five million pounds by nearly 90%.

A 25% annual premium discount is available for dairy producers who sign up for 2019 and commit to maintaining coverage decisions through 2023, the life of the Farm Bill.

Dairy producers who participated in MPP-Dairy from 2014-2017 are entitled to a refund for a portion of their premiums in one of two ways: 50% of paid premiums in the form of a check or 75% of paid premiums as credit applied to future DMC premiums.

For Example

Real life examples are the clearest means of illustrating how premiums are calculated and payments triggered.

A Registered Jersey dairy with 175 cows and a herd average of 17,630 lbs. milk during 2011 to 2013 will have a historical production base of just over three million pounds (30,000 hundredweights) per year. The producer desires to purchase coverage at the $9.50 level for 50% of their historical production. The annual premium would be $2,250 calculated as follows:

3,000,000 lbs. x 50% = 1,500,000 lbs. / 100 = 15,000 hundredweights x $0.150 fee = $2,250

The Jersey producer would receive a payment any time FSA announces the income over feed cost level to be $9.50 or less. When the January 2019 income over feed cost margin was recently announced at $7.99 per hundredweight, the dairy will be eligible to receive about $1,877.50. This is calculated as follows:

$9.50 – 7.99 = $1.51 difference

15,000 hundredweights / 12 = 1,250 hundredweights production per month

$1.51 x 1,250 = $1,877.50

Other Farm Bill Programs

Dairy producers also have opportunity to use the Livestock Gross Margin for Dairy (LGM-Dairy) and the Dairy Revenue Protection (Dairy-RP) to manage economic risk. Both programs come with assistance to cover the cost of premiums that are like Federal Crop Insurance. The Farm Bill allows farmers to use all three risk management programs at the same time.

The bill also includes a new milk donation program to assist with milk donations to food banks, incentives to encourage purchase of fluid milk by households that receive nutrition assistance benefits, and the development of at least three innovation centers for dairy products.

Other titles that may be of assistance to dairy producers include the Trade Title, which offers funds to develop export markets, the Rural Development Title, which assists farmers planning to install renewable energy systems, and the Conservation Title, which includes the Environmental Quality Incentives Program.