Negative PPDs, De-Pooling on Horizon for Dairy Producers

Dairy producers can expect to see negative Producer Price Differentials (PPDs) in the coming months because of the highs and lows of milk prices in Federal Milk Marketing Orders (FMMOs) since late March.

At the annual meeting of National All-Jersey Inc. (NAJ) in late June, General Manager Erick Metzger explained how PPDs come about and their potential impact on the milk check for July, August and September.

Impact of Producer Price Differentials

As with dairy demand, we are navigating unprecedented territory with Federal Order pricing. Producers can expect to see significant negative PPDs, widespread de-pooling of milk and a substantial price lag between uniform milk price and Class III price in the coming months.

This is largely due to the run-up of prices in May and June and the six-week lag between FMMO fluid milk prices (announced prior to the month) and manufacturing milk prices (announced the next month). Most often, significant market changes do not happen in that time frame. The coronavirus pandemic, though, has been anything but normal.

When we look at May and June, price relationships among the milk classes started normal but changed dramatically. For May, the Class I price was $12.95 per hundredweight (announced April 22) and the Class III price was $12.14 (announced June 3). For June, the Class I price announced on May 20―the trough of the price cycle―was $11.42. Six weeks later, on July 1, the Class III price was announced at $21.04, nearly $10 more than the Class I price for June.

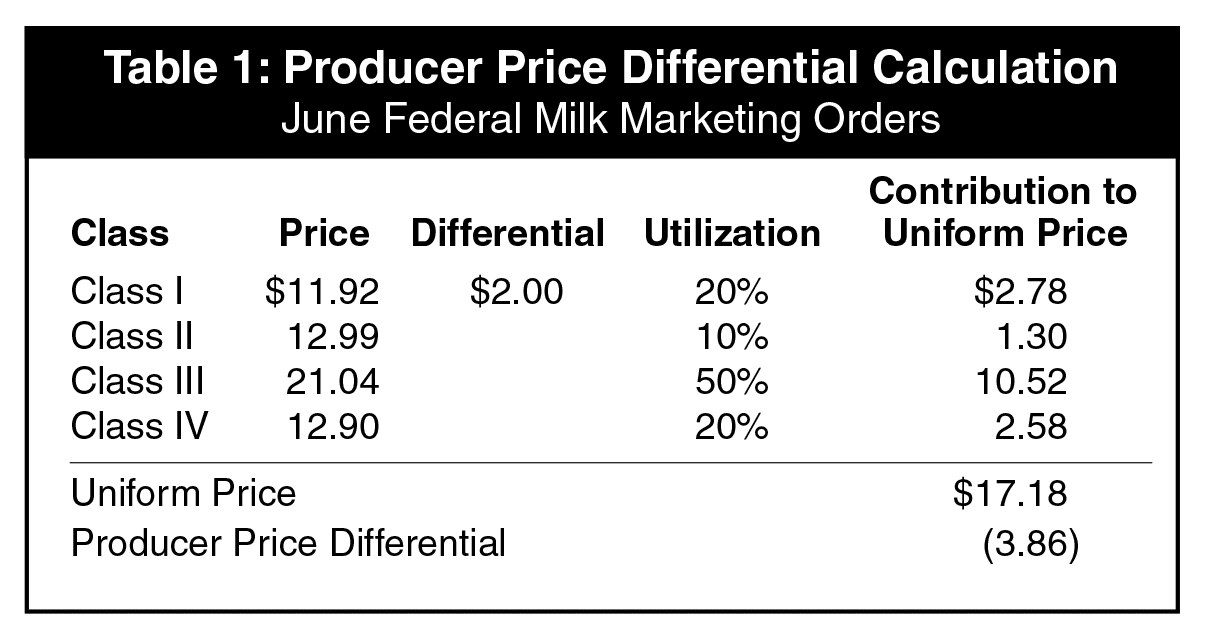

This sets up the situation for the negative PPD. A hypothetical scenario (Table 1) of a FMMO pool using June prices illustrates this point. Keep in mind PPD is an adjustment between the Class III price and the uniform price―a weighted average of Class I, Class II, Class III and Class IV milks in a FMMO―and that producers are paid off the Class III price.

In our example, Class I milk is utilized 20%, Class II is 10%, Class III is 50% and Class IV is 20%. Thus, Class I milk contributes $2.78 to the uniform price, Class II contributes $1.40, Class III contributes $10.50 and Class IV contributes $2.65. The cumulative uniform price is $17.33. Because this amount is less than the Class III price, there is a negative PPD of $3.67.

Class III processors must pay this $3.67 per hundredweight to the Federal Order if they pool their milk. However, they are not obligated to pool their milk. They can de-pool milk and forego paying the Federal order. De-pooling Class III milk causes the percentage utilization of the other lower-priced milk classes to increase and to lower the uniform price. In our example, if all the Class III milk is de-pooled, Class I milk is utilized 40%, Class II is 20% and Class IV is 40%. The uniform price drops to $13.66.

The two overriding concepts associated with de-pooling are: 1.) due to de-pooling, the value of Class III milk will not be reflected in announced FMMO prices; and 2.) the question of how Class III value will be accounted for in milk producer checks remains to be answered.

Independent producers will be paid according to their contracts with their processors. The vast majority of milk is marketed by co-ops, which have three basic options for handling the value of de-pooled milk. They can add it to producer milk checks as premiums or bonuses above the announced FMMO values. They can include the value in their annual, so-called 13th check. Or they can hold the value in retained earnings.

Given current future market price, negative PPDs are likely to persist for July and August and may continue for September.

Other Topics

Metzger also discussed two other topics in his address to members: results from the A2 beta casein study co-funded by NAJ and the A2 Milk Company and dairy markets during the pandemic. For additional information on the A2 study, read the June 2020 NAJ Equity Newsletter or watch a video on the AJCA YouTube Channel. Read about dairy markets in a previous post.