Dairy Risk Management Negated by Negative PPDs in 2020

To say the year 2020 was a difficult one is an understatement, especially for business owners trying to manage income and expenses. Like other entrepreneurs, dairy farmers have insurance programs to help them manage risk for the price they receive for their milk.

So, just how effective were these programs in 2020, in the midst of market turmoil? If one had a crystal ball in 2019 and had taken all precautionary measures to reduce risk, could a producer effectively mitigated risk in 2020?

While dairy producers have historically foreseen squeezed margins from low milk prices and high feed prices, nothing could have prepared them for the rollercoaster prices of Class III milk in the Federal Milk Marketing Order (FMMO) system from March through October.

This led to widespread negative Producer Price Differentials (PPDs), which sparked massive de-pooling of Class III milk and smaller milk checks, despite record-high prices for cheese and Class III milk.

To glean some insight on the effectiveness of risk management programs, National All-Jersey (NAJ) Inc. ran a case study on a producer in the Mideast Order who managed risk by-the-books. This producer utilized three USDA-sponsored risk management programs – Dairy Margin Coverage (DMC), Dairy Revenue Protection (DRP) and Livestock Gross Margin-Dairy (LGM-Dairy) – to protect his business.

So what did the study reveal? Ultimately, de-pooling of milk hindered the efforts the dairy producer took to protect his paycheck.

For the dairy industry, light at the end of the tunnel comes from markets that appear to be returning to normal and the understanding that something better needs to be done to enable dairy producers to protect their businesses.

Dairy industry stakeholders are contemplating options to limit de-pooling and analyzing other aspects of the FMMO system as well. As concepts are developed into proposals, NAJ will analyze them for their potential effectiveness and their impact on dairy producers milking Jersey cows. If you are interested in receiving news from NAJ or would like to receive the NAJ Equity Newsletter, send us an email.

To learn more about the case study, read the post below. The article is also available for viewing as a PDF in the December 2020 Equity Newsletter.

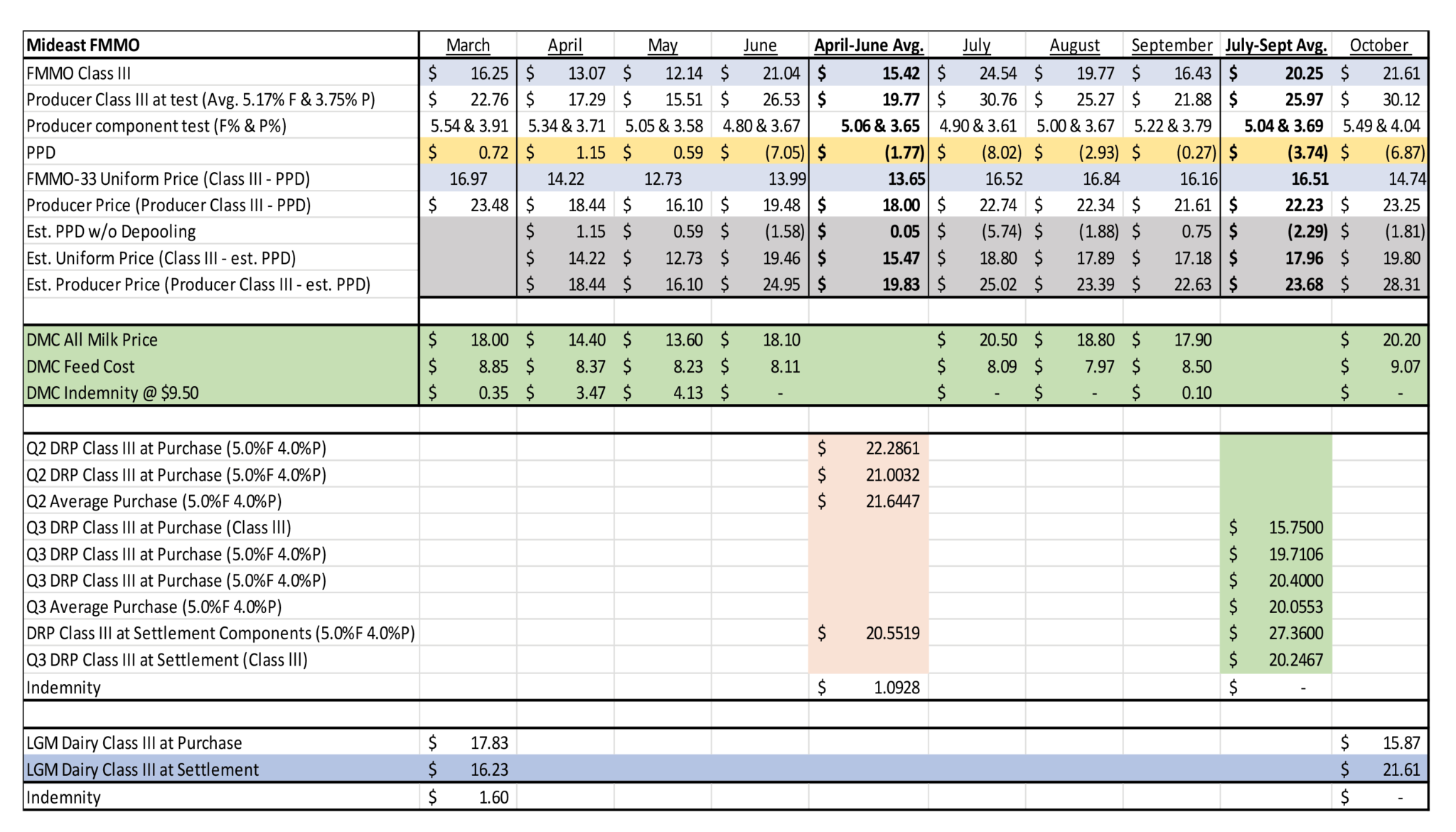

Table One

The table above shows details for the case study dairy farm that markets milk in FMMO 33. You will find:

• FMMO Class III price by month from March through October.

• Value of Producer Class III milk using dairy’s actual component levels.

• PPD for FMMO 33.

• FMMO 33 Uniform Price.

• Producer Price (calculated by adding/subtracting PPD from the Producer Class III price).

• Estimated PPD without De-pooling (NAJ combined the pooled volume and prices of Class I, II and IV milks for 2020 with the volume of pooled Class III milk for 2019 at 2020 prices. Months with negative PPDs would continue to have negative PPDs even without de-pooling. But, because significantly more Class III value would have been pooled, the PPDs would have been substantially less negative.).

• Estimated Uniform Price using the revised PPD.

• Estimated Producer Price for the dairy using the revised PPD.

Impact of De-pooling with DMC

When the DMC program became available in 2019, the dairy enrolled for five years at the $9.50 income-over-feed-costs (IOFC) level for their first five million pounds of annual production.

DMC uses the U.S. all-milk price to determine milk value. The all-milk price is defined as the gross price farmers received in the given month for milk sold at average butterfat test.

A cursory comparison of FMMO prices and the U.S. all-milk price shows that negative PPDs are likely not factored into the all-milk price. Months with positive PPDs have all-milk prices approximately $0.50/cwt. higher than a weighted average of FMMO uniform prices, and most of the difference can probably be attributed to the fact that FMMO uniform prices are reported at 3.5% butterfat, which is lower than the average butterfat test included in the all-milk price.

From June through October 2020 — the months with negative PPDs — the all-milk price averaged $2.40 more than the uniform price, or $1.90/cwt. more than the typical price relationship.

If de-pooling causes the all-milk price to be overstated, then DMC IOFC margins will also be overstated, resulting in indemnities being less than they should be, or not paid at all.

For example, the all-milk price for June was $18.10. When combined with DMC’s calculated feed cost of $8.11, that month’s IOFC was $9.99/cwt., and no indemnities were paid to producers who were insured for $9.50.

However, if de-pooling caused that month’s all-milk price to be overstated by $1.90, DMC would have paid a $1.41 indemnity for milk insured at $9.50 ($16.20 all-milk price – $8.11 feed cost = $8.09 IOFC).

Using the same assumptions for July through October, producers insured for $9.50 IOFC would have received DMC payments of $0.57/cwt. in August, $2.00/cwt. in September and $0.27/cwt. in October.

Impact of De-pooling with LGM-Dairy

LGM-Dairy also insures IOFC by simultaneously buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

This case study dairy produces over five million pounds of milk annually, so it occasionally utilizes LGM-Dairy as a risk management tool. In 2020, the dairy purchased LGM-Dairy contracts for March and October.

Because de-pooling only impacts revenue, this analysis looked solely at the income side of the equation alone. For the March contract, the Class III price declined from $17.83/cwt. when it was purchased to $16.23 at settlement, providing an indemnity of $1.60 on lost revenue. For the October contract, the Class III price increased from $15.87/cwt. at purchase to $21.61 at settlement, a gain of $5.74, resulting in no indemnity payment.

The increase in milk prices should be viewed as a positive development for producers, but let’s look at the end result.

When the LGM-Dairy contract was purchased, Class III futures were $15.87. When normal class-price relationships exist, the PPD for Order 33 typically averages $0.60/cwt. Thus the producer was expecting a uniform price of about $16.47. Even though the Class III price ran up to $21.61, the uniform price was $14.74 because of de-pooling and a subsequent -$6.87 PPD. This more than wiped out the entire $5.74 gain in the Class III price.

The dairy missed opportunity to receive both an indemnity payment and the large gain in the Class III price.

Without de-pooling, the PPD would have been in the range of -$1.81. The uniform price would have been $19.80, an amount that is $3.33 higher than the anticipated uniform price when the LGM-Dairy contract was purchased, which is a more effective hedge.

Impact of De-pooling with DRP

Dairy RP has three primary differences from DMC and LGM-Dairy. First, it hedges revenue alone; feed costs are not part of the equation. Second, it is based on calendar quarters instead of individual months. Third, producers can base their expected revenue on Class III and IV or pounds of butterfat and protein, whereas DMC and LGM-Dairy are based strictly off of the standard Class III price calculated at 3.5% butterfat and 2.99% true protein.

The dairy purchased two separate DRP contracts for the second quarter, April to June. Having high component Jerseys, the dairy opted to insure their butterfat and protein value at 5.0% fat and 4.0% protein.

The two contracts floored the dairy’s Class III value at an average of $21.64/cwt. That quarter’s FMMO settlement prices valued milk with 5.0% butterfat and 4.0% protein at $20.55/cwt., and the dairy received a $1.09/cwt. indemnity payment.

However, the dairy’s actual Class III value for the quarter averaged $19.77. The PPD for Order 33 averaged -$1.77 due to massive de-pooling of Class III milk in June. That brought the dairy’s pay price down to $18.00/cwt., which was $3.64/cwt. less than the floor they set with DRP. The $1.09 indemnity payment closed the gap to $2.55/cwt., but far below the floor the dairy intended to set.

If Order 33 had as much Class III milk pooled in June 2020 as was pooled in June 2019, the average PPD for the quarter would have been $0.05, an improvement of $1.82/cwt. In that scenario the dairy’s realized pay price, including the $1.09 DRP indemnity, would have been $20.92/cwt., much closer (within $0.72) to their target price of $21.64.

The opposite scenario happened in the third quarter. The dairy purchased three different DRP contracts for July through September. One was a basic Class III contract for $15.75, and the other two were component contracts (5.0% F and 4.0% P) that averaged $20.05/cwt. Following those purchases, the average Class III price for the quarter skyrocketed to $20.25, a gain of $4.50. The value of the component contracts jumped to $27.36, a gain of $6.96/cwt. Obviously the dairy didn’t receive indemnity payments, but did they realize the gain in Class III value?

During the third quarter, the PPD for Order 33 averaged -$3.74, which eroded the $4.50 gain in the basic Class III price down to $0.76. The dairy’s pay price of $22.23 was $2.18/cwt. more than the floor they set at $20.05, but nowhere near the $6.96 runup in in the value of their components following the contract purchases. Without de-pooling, the Order’s PPD would have averaged -$2.29, an improvement of $1.45.

Summary

As this case study shows, de-pooling, which in turn exacerbates negative PPDs, severely impacts the effectiveness of risk management programs.

While Federal Orders have occasionally experienced negative PPDs in the past, they have never been of the magnitude that happened this year. Of course, 2020 has been an unprecedented year on many fronts, including dairy commodity price volatility.

The Farmers to Families Food Box program helped to rally cheese prices to record levels, providing price relief to producers, while also assisting families in need. However, the cheese price rally also led to record differences between the Class III and IV prices, resulting in the higher-priced Class III milk to be de-pooled.

Looking ahead to 2021, the Food Box program is not expected to be continued. If it is, it will not be on the scale seen in 2020. As well, cheese production capacity is expected to be significantly larger next year. With both developments, normal relationships between Class III and Class IV prices are expected to return. However, the potential for negative PPDs accompanied by de-pooling continues to exist.